3-Step Demand Generation Strategy for B2B Fintech Sector

As a fintech marketer, you must be experiencing a rapidly evolving financial tech industry. Several new products come and go in the market. But only a few sustain their usefulness.

Thus, generating demand for your new or existing product is critical. You must create interest and drive demand for your company's products or services among your target audience. In the fintech world, this task becomes complicated as you'll have to navigate strict regulations and fierce market competition.

However, with an effective B2B fintech demand generation strategy in place, you can excel in your marketing goals.

So, let us share the 3 step demand generation strategy you need for the best results. But before that …. [a connecting line to the below section]

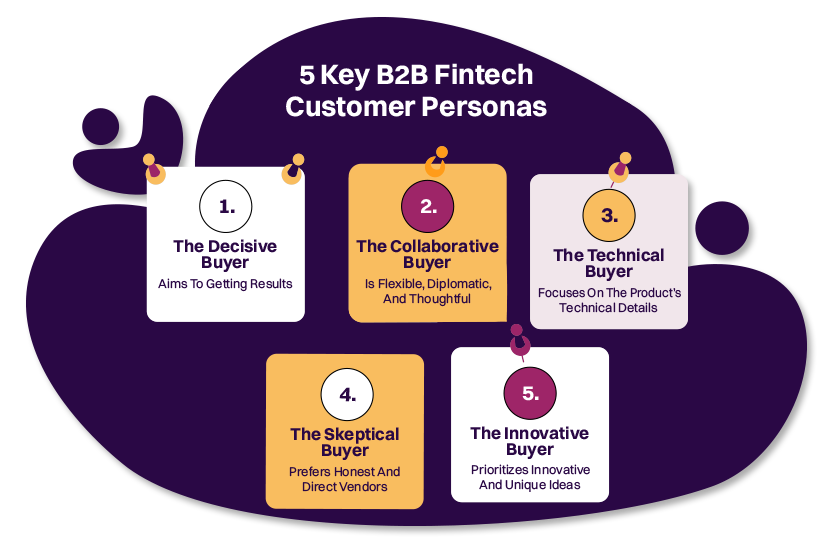

5 Buyer Personas In B2B Fintech Sector

Have you ever considered the different buyer personas that are there in the market? Well, for any business, understanding these buyer personas is crucial to ensure that they are targeting the right customers.

Though a B2B demand generation agency with expertise in financial sector can help you differentiate your buyer personas, here are some basic ones you must know:

1. The Decisive Buyer

Decisive buyers are proactive prospects, focused on getting results, and always want their company to stay ahead of the competition. Usually, they don’t require others' input to make final purchasing decisions.

Decisive buyers know very well what the organization requires. Thus, to sell to these decisive buyers, do the following:

- You should always be direct about your offering.

- You must highlight how your product can help the buyer achieve their goals.

- You must highlight how your offering fits their current and future goals.

2. The Collaborative Buyer

The collaborative buyer is quite different from the decisive one. They enjoy working with others to solve problems and tend to be flexible, diplomatic, and thoughtful. Remember that building consensus is important when you sell to collaborative buyers.

Thus, you should:

- Learn about which people influence the organization's decision-making process.

- Ensure your offering meets each of these people's needs.

- Facilitate discussions and be open to answering the buyer's questions or concerns.

3. The Technical Buyer

The technical buyer refers to a company's top executive. They are likely to stay updated on the latest industry technology and trends. Their technical knowledge and leadership in a product or service are looked upon.

Therefore, you should approach them in the following ways:

- Since they are well-informed, your marketing efforts should focus on technical details.

- Mention how your product will fit with their existing system.

- Provide examples of previous successful deployments. It's important not to be pushy or disappear after making the initial sale.

Furthermore, if your product or service satisfies technical buyers, they may influence the organization to become long-term clients.

4. The Skeptical Buyer

B2B fintech customers who are skeptical tend to be thoughtful and critical in their thinking. They don't like exaggerated claims and prefer honest and direct vendors. It can take them longer to trust new vendors and their products.

Thus, you should:

- Avoid making bold claims over the phone or in sales emails when marketing to skeptical buyers.

- Moreover, they are unlikely to even receive sales calls. Therefore, you must offer them helpful content first. It may include research reports, product descriptions, and case studies. It allows buyers to explore your product at their own time and pace.

5. The Innovative Buyer

Innovative buyers like to think outside the box and endorse ideas to innovate the industry. They're interested in the latest technology and want to solve problems creatively.

Thus, you should:

- Be open to brainstorming and unique thinking to appeal to these buyers.

- Focus on the overall picture and how your product can help the buyer achieve their goals and even surpass them.

So, these are the main types of fintech personas. Now, let’s learn about the demand generation framework for B2B fintech.

How Revnew helped Remodel Health reach the target audience to market their services.

A 3-Step Demand Generation Strategy for Fintech Sector

Let us begin with the effective steps that can create a successful demand generation funnel.

Step 1: Create Product Demand

To create product demand, you must know the customer’s needs, preferences, and behavior. It includes:

- Analyzing your sales process’s performance.

- Finding reasons why customers prefer you and what’s currently missing in existing products.

- Exploring what you can offer better than your competitors.

You can find the information regarding the above pointers by using the following B2B demand generation tactics:

1. Conduct Deep Market Research

Start with analyzing the company’s internal data before conducting external research. It helps you focus on relevant data and avoid any unnecessary information clusters. For this, you can:

- Review your website's conversion funnel.

- Assess email marketing performance by product category.

- Analyze past product launches.

- Evaluate previous social media campaigns.

Furthermore, you can also get information through external sources, including the local Chamber of Commerce reports, the Census, and Google Trends. Additionally, conducting interviews with customers with open-ended questions can help you understand why people prefer your offerings.

2. Evaluate Competitors

To get started, create a list of your main competitors in the market. Then, copy and paste their marketing messaging that describes their product features and benefits. However, it's important to stay true to your mission and target customers and avoid copying another brand's idea. Finally, conduct a SWOT analysis of each competitor by evaluating their strengths, weaknesses, opportunities, and threats.

It'll help you better understand your competition and focus on areas where your product/service can differentiate itself.

3. Identify Market Gaps

People tend to hesitate to try or buy a product unless something motivates them to act. Discovering your brand's trigger can help increase conversions. It's important to understand your customers' needs, purchasing process, and market gaps to find this trigger. You can do this by:

- Asking your potential customers what the current market is missing

- Researching industry trends to find areas that must be explored

- Conducting customer surveys to gather information on their needs and want.

These methods can help identify gaps in the market that you can target.

Thus, you can identify and remove any obstacles that might stop potential customers from buying your product. And in fact, this is one of the primary benefits of a demand generation agency. They can identify the gaps and even help you remove them seamlessly.

Step 2: Increase Demand

After you complete your research and get all the needed insights, start working towards boosting your service/product demand. For this, you’ll have to take the help of marketing tactics. Here are a few effective methods you can employ:

1. Deploy A Channel-centric Marketing Strategy

A successful strategy is to focus on customer segmentation based on channels. It is particularly effective for those aiming to achieve branding success in the long run. Customer segmentation involves grouping similar demographics (age, gender, etc.) together and designing your marketing efforts for specific groups.

The channel-centric approach will use data about these groups to create strategies tailored to different channels, such as social networking sites, email, or direct mail.

2. Educate Through Content Marketing

Effectively educating target customers is undoubtedly important for demand generation. Therefore, you must leverage effective content marketing strategies to make it happen.

These strategies may include the following:

- Cold-calling and cold-emailing to connect with new prospects.

- LinkedIn marketing and Facebook groups to target specific demographics with tailored content.

- Direct mail campaigns if you are targeting a local region. You can send product catalogs and postcards offering discounts and coupons with direct mail. You may also share information on how to access a demo trial of your product.

- Social media sites like Reddit reach niche communities. Reddit attracts more than 60 million unique monthly visitors from the US alone. Thus, linking your product or services in between texts you share will help people discover your product.

In addition to these methods, promoting your website blogs through SLACK and Discord channels is a must. These two platforms are rapidly becoming hubs for professional communication. Thus, sharing informative and engaging content and providing links to your website will ultimately let people learn about your offerings.

3. Leverage Scarcity To Increase Demand And Conversions

Scarcity is a powerful psychological trigger that can increase demand and conversions. Creating a sense of urgency or exclusivity allows you to tap into consumers' fear of missing out (FOMO).

- One way to leverage scarcity is to offer invite-only sales or services. It can make customers feel special and increase their desire to be part of an exclusive group.

- Another approach is to offer daily deals or limited-time offers, which creates a sense of urgency in potential customers. Further, it encourages them to act quickly.

By leveraging scarcity in these ways, you can increase demand and conversions. Ultimately, it will drive growth and profitability. In fact, this is the prime point of difference between demand generation vs. lead generation. Basically, the potential to convert a lead drives the demand generation.

4. Apply Physiological Nudge To Influence Purchase Decision (Decoy Effect)

The decoy effect is a phenomenon where introducing a third option (decoy) influences the decision-making process between two other options. The decoy is strategically placed to make one option appear more attractive than the other.

It's one of the great B2B demand generation practices that nudges your target clients physiologically to take desired action.

It manipulates the prospect's view of the presented offering. Hence, you can use it to nudge your target consumers toward a particular purchasing choice.

Check out this example of the decoy effect:

%20.png?width=814&height=451&name=apply-physiological-nudge-to-influence-purchase-decision-(decoy-effect)%20.png)

When consumers have multiple options to choose from, they may feel overwhelmed and find it hard to make a decision. To make it easier, they focus on just a few things, like the price and amount, to determine the best option. You can use this opportunity by highlighting certain features to influence people's choices and make them feel like they made a good decision.

Step 3: Turn Product Demand Into Sales

Now, it’s time to generate sales opportunities from your captured financial leads. So, once your product-qualified leads (PQLs) come into your radar through marketing, show them why they should purchase your product/service. You can use the following sales strategies to entice them:

1. Consider Different Sales Strategies

With different sales strategies, you can both create wider lead sources and analyze which methods work best for you. So, here are a few strategies to try:

- Introduce Loyalty Programs And Memberships

Use loyalty programs and memberships to encourage your B2B customers to continue partnering with you. In fact, over 90% of companies offer some form of loyalty program. To make it easier, and create personalized rewards programs that engage with existing customers in the best way possible. Additionally, this method helps you attract new high-quality financial leads without starting from scratch.

- Embrace Subscription Models

A subscription model is a great way to ensure your product's sales stay consistent. Therefore, ensure to offer discounts or other incentives to encourage customers to subscribe instead of making a one-time purchase and leaving.

- Evaluate Barriers To Closing Sales

To increase demand and close sales, it's essential to understand what drives it. After a significant product launch, schedule a post-launch review about two weeks later. Look at the key performance indicators (KPIs) you set and find answers to the following questions:

- What went well and what didn't throughout the product launch?

- How much was product demand generated?

- Did you meet the generated demand for your product?

- How to continue generating demand for the particular product in the future?

2. Create Demand To Upsell/Upgrade The Service

Besides bringing new customers through demand generation, you shouldn't miss the chance to upsell your service. Doing so will help you engage with new buyers and re-generate interest in existing ones. Here's how you can do so:

- Analyze customers' past purchase history and preferences to personalize your offers. By offering relevant and targeted upsells, you can increase the chances of conversion.

- Showcase the benefits of the upgraded service and how it can help the customer achieve their goals. Leverage case studies, testimonials, and demos to prove your point.

- Use incentives such as discounts or loyalty rewards to encourage customers to upgrade. These strategies help you create demand and increase the likelihood of upselling and upgrading among existing customers.

Conclusion

Applying a B2B demand generation strategy is crucial to create interest and drive demand for offered solutions. You can educate your audience on the benefits of your offerings through effective content marketing, targeted advertising, and thought leadership. It helps build trust with potential clients. Moreover, these effective B2B demand gen strategies help you remain competitive in today's evolving fintech industry.

We must mention that prospecting can consume much of your and your team’s time. Additionally, it may halt your other important business processes. So, why shouldn’t you hire an all-rounder demand generation agency to generate demand and help nurture your leads? We at Revnew ensure your product gets attention from the right prospects so that your sales process sees success early on. Contact us here.